They say you can’t make an omelette without breaking eggs, but in India, we’re breaking a lot without making much of anything. Of the 142.77 Bn eggs produced annually, nearly 1% are damagedbefore they reach any kitchen. That’s over a billion eggs wasted every year.

But this is not only about wastage. India’s egg consumption is rising fast. The market, already worth over $7.94 Bn in 2025 and is expected to grow at an annual growth rate of 10.31%from 2025 to 2030. Yet, quality hasn’t kept up with demand. Around 95% of the industry remains unorganised, supply chains are opaque and quality control is practically non-existent.

Even with brands like Licious, Eggoz, FarmMadeFoods, HenFruit and Dr. Hen in the mix, buying eggs remains a gamble as the majority of the eggs on the shelves are unbranded. Most eggs available in the market are already 7 to 10 days old, and consumers have no way of knowing whether they’ll crack open something clean, fresh or contaminated.

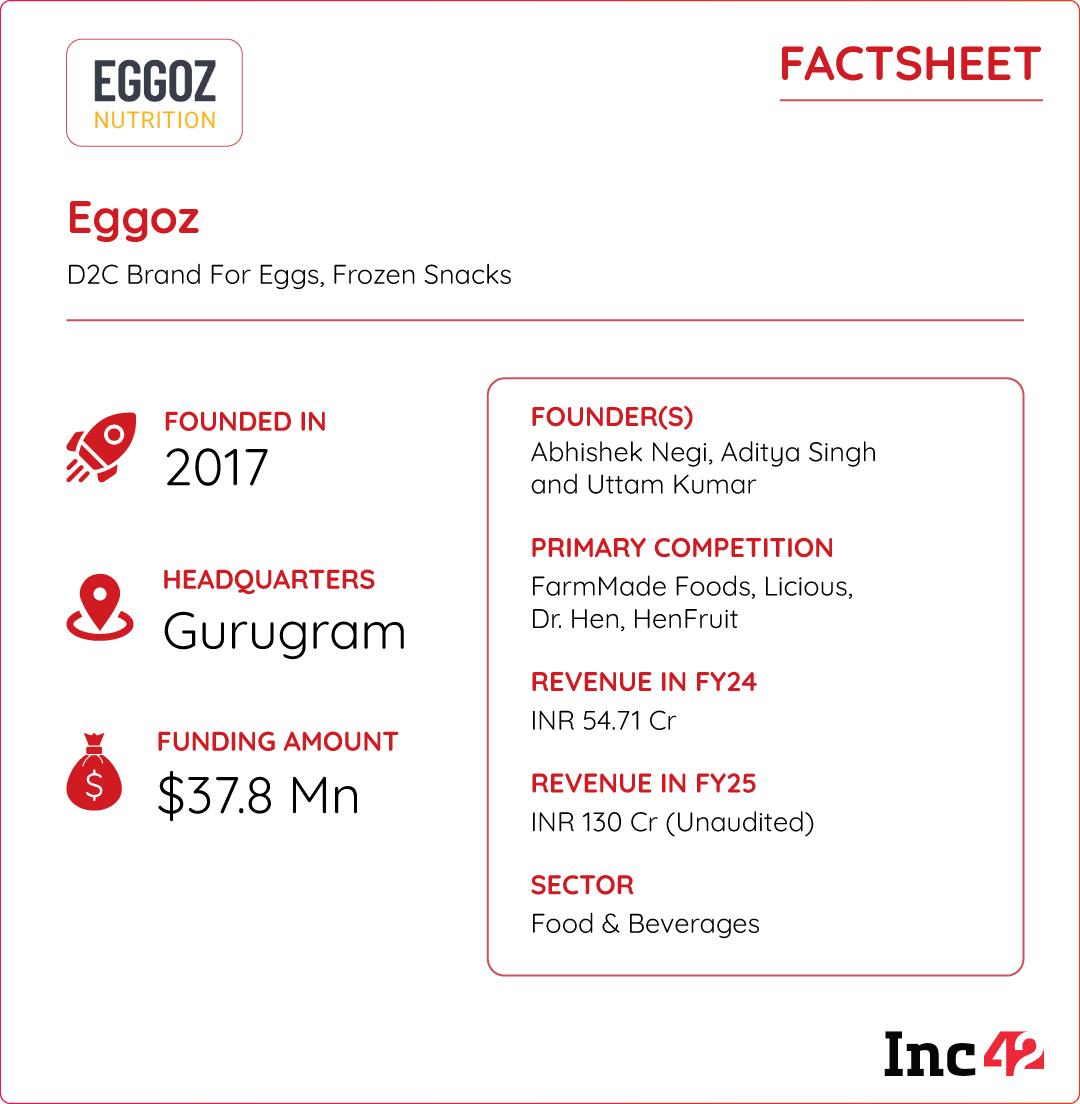

That was what three IIT alumni — Abhishek Negi, Aditya Singh and Uttam Kumar — wanted to solve and they founded Eggoz in 2017 to fill the trust and quality gap. But breaking into this massive and massively unorganised market wasn’t easy at all, especially because neither of them knew anything about eggs or the poultry industry.

Fast forward eight years, today Eggoz sells over 2 Cr eggs in a month through retailers and quick commerce platforms, including Blinkit, Zepto, and Swiggy Instamart.

But in those eight years, a number of competitors have also arrived on the scene, looking to do the same thing that Eggoz set out to do.

This is why the company is leveraging its recent $20 Mn Series C round to improve logistics and enter new cities — two moves it feels will unlock more growth and profitability over the next year.

“The fresh funding will be used to ramp up warehousing, expand farm partnerships and push further automation to protect the supply chain from the unique challenge of fragility. Our focus over the next few years will be to double down on what’s already working — but at a much larger scale,” Negi told Inc42 soon after the round was closed.

Eggoz claims to have seen 137% jump in revenue in FY25 — from INR 54 Cr in March 2024 to INR 130 Cr in March 2025. Negi also claimed that the company broke even in Q4 FY25 at the EBITDA level and trimmed its net losses by 28%, from INR 25 Cr in FY24 to INR 18 Cr in FY25.

But as stated before, this is not an industry without competition, and even quick commerce companies such as Zepto and BigBasket have their own branded egg products under Relish and Fresho respectively.

Others such as Blinkit might also move to a private label model, given that the company has turned to an inventory model in recent months.

Along with competition in the meat and eggs space, Eggoz will have to contend with how these private labels will change the dynamics within quick commerce delivery. So how does Eggoz plan to stave off the rivals?

Before D2C brands in the egg and poultry industry, the Indian market was dominated by unbranded egg supply. Retail shelves rarely stocked branded eggs, even though large scale poultry farms and integrated producers.

In fact, such producers make up for 70% of the market today, which is classified as organised. But the organised segment often had quality discrepancy due to the lack of control or transparency in production practices. Rising feed costs also contributed to corner cutting in large farms. To maintain low production costs and high output, many resort to using chemical additives, growth hormones, and antibiotics, raising concerns around egg quality and safety.

When it started out, Eggoz decided to own poultry farms, both new and acquired, to produce eggs and then sell them to wholesalers. There was no brand play, but the focus was on building operational expertise and understanding quality control.

It started with a 12,000-bird farm in Bihar, followed by a 30,000-bird farm in Madhya Pradesh, and by 2020, the startup was managing over 1 Lakh chickens through captive farming.

“Every egg we sell is produced using 100% herbal feed, completely free from chemicals and synthetic additives. Whenever our birds require dietary support like probiotics or vitamins, we ensure only herbal supplements are used, maintaining a natural and clean nutrition cycle,” the cofounder claimed.

When the pandemic hit in 2020 though, Eggoz had to swiftly change to an asset-light D2C model and create processes that were built around operational parameters and a tech stack.

This was particularly important as farm operations were severely impacted. Negi claimed this was an “Amul-like opportunity for eggs”, so the company moved from owning farms to an asset-light model

“We shut down our poultry farms and pivoted to a farmer integration model—where we control the inputs, quality, and technology, but the farmer owns and runs the farm,” the cofounder explained.

Eggoz signed exclusive deals with partner farmers across the country, purchasing 100% of their egg output. The first step is detailed farm audits which deal with biosecurity, hygiene, and antibiotic-based feeds or input.

Post-onboarding, every farm has to follow Eggoz’s mandated herbal feed diets and farm SOPs. It’s akin to a franchisee or cooperative model, followed by many dairy giants.

To enable real-time monitoring, partner farms are equipped with basic sensors and a mobile app where farmers log daily data — egg count, mortality, feed input, and environment metrics.

Eggoz’s backend algorithms then flag any deviation from norms and prescribe corrective actions. Currently working with over 25 farmers, each partner farm is located within 5–6 hours of key consumption hubs.

Solving The Supply SideWhile farm operations and the sourcing model were being streamlined, Eggoz wanted to solve the ‘fragility’ problem which is inherent in the egg industry.

Eggs, by nature, are delicate and that creates cascading challenges across the supply chain — farm to table. This meant everything, from farm-level handling, third-party logistics, processing centres and last-mile delivery, needed a heightened level of care.

Negi says the company’s wastage ratio is extremely low, despite the fundamentally different and difficult nature of logistics here.

The first step was automation to reduce human error. Machines were brought in for processing, sorting and packaging of eggs. No human workers handle these eggs as they are being readied for final distribution.

“Automation certainly helps, especially when you’re delivering crores of eggs. Manual operations have limits. We’re always chasing better numbers, and if automation helps reduce breakage or optimise supply chain costs, we’ll double down on it,” Negi added.

He further claimed that production costs are higher than the market average, but customers value the visible difference in quality of the final product. Each egg goes through 11 safety checks — including grading, cleaning, and defect detection — before being packed and delivered within three days of laying.

“We maintain a high rejection rate—nearly 20–25% at times—because we don’t compromise on shell quality, cleanliness, or yolk consistency,” added Negi.

Cracking Distribution And Pricing PuzzlesDistribution is vitally important. In India, over 95% of eggs are still sold loose—often unbranded, untracked, and with minimal consumer awareness about freshness or safety.

Unlike milk or packaged foods where legacy players have spent decades shaping consumer behavior, the branded egg category is still nascent. Eggoz sees this as both a challenge and an opportunity.

Instead of going premium-only or online-first, Eggoz carved out a strategic edge by winning trust at the grassroots, starting with kirana stores. “Our first-ever sale wasn’t in a gourmet store but a kirana store in Gurugram,” recalled Negi.

This aligns with the vision to build brand trust at the point of daily, habitual purchases.

He claims that this go-to-market strategy meant Eggoz had to prioritise affordability, unlike competitors such as FarmMadeFoods and HenFruit, which operate at higher price points. Meanwhile, larger startups such as Licious consider eggs as a side offering and therefore do not have the complete stack needed to compete on price.

Besides this, Eggoz’s omnichannel strength, particularly in general trade (GT), has become a key moat, since this increases the customer stickiness.

A similar loyalty can be built on quick commerce too, but a quick glance at the pricing of eggs on Blinkit, Instamart, Zepto and other platforms shows that Eggoz is often not the most affordable option.

However, QC can be a gamechanger for such categories. “Quick commerce is built for frequency, and when consumers trust the brand, they reorder every few days. That drives momentum. We’re already tracking 2X growth, and that’s the minimum we’re aiming for; we’re confident we’ll surpass it.”

Eggoz Takes The Frozen ChallengeNegi wants to leverage the new round to double down on the ‘egg tech stack’, infrastructure and supply chain partnerships. Warehousing will be a key area of expansion, alongside deeper collaborations with farmers to scale volume sustainably.

“You’ll see a lot more warehousing coming up, and we’ll be tying up with more farmers to significantly scale volumes,” said Negi.

This hints at a major pan-India expansion and availability through quick commerce in smaller cities, in addition to the kirana stores.

The founder also believes that extending brand recall beyond quick commerce is essential for Eggoz, since it is now expanding into egg-based frozen foods and snacks.

This is a logical extension of the existing business, but one that brings its own operational complexity. Eggoz says its world-first ‘egg momos’ which were launched in Delhi NCR through select online platforms, have shown “decent growth and repeat rates”.

The frozen foods line is manufactured by Eggoz, but the rollout has been intentionally gradual given the demands of cold chain logistics. The segment is still under a year old, and while more frozen SKUs are in development, the company has not yet disclosed a revenue split or launch timelines.

“We’ve held back on scaling too fast because frozen needs a different kind of supply chain discipline,” he noted.

For the time being, fresh eggs are the heart of Eggoz’s operations. In a category long defined by loose, unbranded supply, Eggoz is betting on structure, traceability, and consumer trust.

It’s important to maintain the supply chain and operational moat, but other egg brands have adopted a similar route to success. Plus, the threat from platform-owned brands in quick commerce cannot be overstated. How long can Eggoz keep this bubbling competition at bay?

With Inputs From Debarghya Sil

The post Cracking The Egg Code: How Eggoz Hatched An INR 130 Cr+ Empire appeared first on Inc42 Media.

You may also like

Gaza crisis: UK to recognise Palestinian state if Israel fails to act on ceasefire; PM Keir Starmer terms statehood as 'inalienable right'

Liverpool star Alexis Mac Allister makes new signings prediction after 'amazing' claim

US Judge blocks Trump law cutting Medicaid; sides with Planned Parenthood, cites unplanned pregnancy spike

NHRC seeks report on deaths due to food poisoning in Telangana Gurukul schools

Man City reject Premier League request and stunned by suggestion amid 115 charges