Mumbai: International Holding Co. ( IHC), one of the world’s largest and most aggressive investment conglomerates, is set to acquire a controlling stake of 40-45% in Sammaan Capital Ltd, formerly Indiabulls Housing Finance, for around $1 billion, according to people aware of the matter.

The Abu Dhabi-headquartered IHC is backed by Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security advisor and one of the most powerful financiers in the world. It’s expected to launch an open offer to acquire an additional 26% from minority investors of the company, said sources. If the offer is fully successful, IHC may end up owning over 65% of the company that’s had a chequered history—swinging between success and fortunes fading. The current management team led by MD and CEO Gagan Banga, deputy CEO Himanshu Mody and COO Sachin Chaudhary will stay on, according to the people cited.

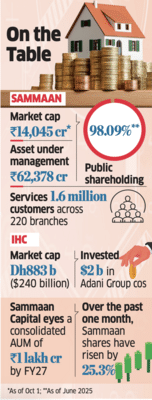

The mortgage-focused non-banking finance company ( NBFC) services 1.6 million customers through 220 branches.

A formal announcement is expected on Thursday. Earlier this week, it had informed exchanges that the board is meeting October 2 to consider fund- raising through avenues such as equity, convertible paper, debt securities and warrants.

Sammaan Capital and IHC didn’t respond to queries.

On Wednesday, Sammaan closed at 169.55 on the BSE, up 5.4%. for a market value of Rs 14,045 crore. Over the past month, the stock has risen 25.3%. The IHC offer is expected at 140-145, taking into account the recent spurt in the share price in anticipation of a transaction. Jefferies and Citi are advising Sammaan Capital.

The company was originally part of the real estate, infrastructure and financial services group that was launched by IIT grads Sameer Gehlaut and Rajiv Rattan. It’s currently widely held after Gehlaut left the country. Saurabh Mittal had joined the duo as a co-promoter. The company currently doesn’t have a promoter with the public shareholding at 98.09% at the end of June. In 2014, Gehlaut and Rattan decided to split the empire after being together 14 years. Gehlaut, the chairman of the then Rs 20,600 crore group, got the flagship housing finance, realty and securities businesses--Indiabulls Housing Finance, Indiabulls Real Estate, Indiabulls Securities and Indiabulls Wholesale Services.

The other two co-promoters, Rattan and Mittal, got the reins of Indiabulls Power Ltd (IPL) and Indiabulls Infrastructure and Power Ltd (IIPL). However, the latter agreed to relinquish their rights to use the Indiabulls brand name after 2014.

IHC, the largest listed company in the UAE with a market capitalisation of about 883 billion dirhams ($240 billion) has been on an aggressive acquisition spree globally. In India, it has already made large-ticket bets, including a $2 billion investment in Adani Group companies through preferential allotments in 2022, and more recently, a minority stake in Haldiram Snacks Foods in partnership with Alpha Wave Global. Earlier this year, the group also launched a $1 billion reinsurance joint venture with BlackRock.

IHC plans to invest as much as $110 billion in India over the next five years, while simultaneously targeting to double its global asset base to 800 billion dirhams ($218 billion) and touch 200 billion dirhams in annual revenue by the end of the decade, according to an interview in The National.

For IHC, the Sammaan Capital acquisition would give it a strategic entry into India’s financial services sector. Sammaan Capital, along with its wholly owned subsidiary Sammaan Finserve, managed assets of Rs 62,346 crore at the end of March, with housing loans accounting for 73% of the portfolio. The loan against property (LAP) portfolio accounted for 18% of the overall AUM, with the remaining comprising commercial credit.

For IHC, the Sammaan Capital acquisition would give it a strategic entry into India’s financial services sector. Sammaan Capital, along with its wholly owned subsidiary Sammaan Finserve, managed assets of Rs 62,346 crore at the end of March, with housing loans accounting for 73% of the portfolio. The loan against property (LAP) portfolio accounted for 18% of the overall AUM, with the remaining comprising commercial credit.

Its growth AUM has reached ₹37,000 crore, rising from ₹26,000 crore last year. While the group reported a loss of ₹2,718 crore in FY25 due to one-time provisioning, its asset quality remains stable with the gross non-performing asset ratio at 0.54% and the net non-performing asset ratio at 0.29%.

The company has been realigning its business toward an asset-light retail model with co-origination and sell-down strategies, while targeting a consolidated AUM of ₹1 lakh crore and an expanded network of 350 branches by FY27.

“All in all, between the AIF, Finserve and Sanmaan Capital, we are continuing to focus on getting to a consolidated AUM of Rs 1 lakh crore by Fiscal 27,” Banga said in a conference call in May.

The Abu Dhabi-headquartered IHC is backed by Sheikh Tahnoon bin Zayed Al Nahyan, the UAE’s national security advisor and one of the most powerful financiers in the world. It’s expected to launch an open offer to acquire an additional 26% from minority investors of the company, said sources. If the offer is fully successful, IHC may end up owning over 65% of the company that’s had a chequered history—swinging between success and fortunes fading. The current management team led by MD and CEO Gagan Banga, deputy CEO Himanshu Mody and COO Sachin Chaudhary will stay on, according to the people cited.

The mortgage-focused non-banking finance company ( NBFC) services 1.6 million customers through 220 branches.

A formal announcement is expected on Thursday. Earlier this week, it had informed exchanges that the board is meeting October 2 to consider fund- raising through avenues such as equity, convertible paper, debt securities and warrants.

Sammaan Capital and IHC didn’t respond to queries.

On Wednesday, Sammaan closed at 169.55 on the BSE, up 5.4%. for a market value of Rs 14,045 crore. Over the past month, the stock has risen 25.3%. The IHC offer is expected at 140-145, taking into account the recent spurt in the share price in anticipation of a transaction. Jefferies and Citi are advising Sammaan Capital.

The company was originally part of the real estate, infrastructure and financial services group that was launched by IIT grads Sameer Gehlaut and Rajiv Rattan. It’s currently widely held after Gehlaut left the country. Saurabh Mittal had joined the duo as a co-promoter. The company currently doesn’t have a promoter with the public shareholding at 98.09% at the end of June. In 2014, Gehlaut and Rattan decided to split the empire after being together 14 years. Gehlaut, the chairman of the then Rs 20,600 crore group, got the flagship housing finance, realty and securities businesses--Indiabulls Housing Finance, Indiabulls Real Estate, Indiabulls Securities and Indiabulls Wholesale Services.

The other two co-promoters, Rattan and Mittal, got the reins of Indiabulls Power Ltd (IPL) and Indiabulls Infrastructure and Power Ltd (IIPL). However, the latter agreed to relinquish their rights to use the Indiabulls brand name after 2014.

IHC, the largest listed company in the UAE with a market capitalisation of about 883 billion dirhams ($240 billion) has been on an aggressive acquisition spree globally. In India, it has already made large-ticket bets, including a $2 billion investment in Adani Group companies through preferential allotments in 2022, and more recently, a minority stake in Haldiram Snacks Foods in partnership with Alpha Wave Global. Earlier this year, the group also launched a $1 billion reinsurance joint venture with BlackRock.

IHC plans to invest as much as $110 billion in India over the next five years, while simultaneously targeting to double its global asset base to 800 billion dirhams ($218 billion) and touch 200 billion dirhams in annual revenue by the end of the decade, according to an interview in The National.

Its growth AUM has reached ₹37,000 crore, rising from ₹26,000 crore last year. While the group reported a loss of ₹2,718 crore in FY25 due to one-time provisioning, its asset quality remains stable with the gross non-performing asset ratio at 0.54% and the net non-performing asset ratio at 0.29%.

The company has been realigning its business toward an asset-light retail model with co-origination and sell-down strategies, while targeting a consolidated AUM of ₹1 lakh crore and an expanded network of 350 branches by FY27.

“All in all, between the AIF, Finserve and Sanmaan Capital, we are continuing to focus on getting to a consolidated AUM of Rs 1 lakh crore by Fiscal 27,” Banga said in a conference call in May.

You may also like

Euston Station evacuated and major police presence as services suspended

Spying for Pakistan: Haryana police arrest YouTuber Wasim Akram in Palwal; chats under investigation

BBC announces return of Peaky Blinders with two new series

Brits urged to 'stay indoors' as Storm Amy hits with 80mph winds this weekend

Bihar: Vijayadashami is celebrated in Patna amid rain